Introduction:

Backtesting is an essential tool for forex traders to evaluate and refine their trading strategies before applying them in live trading. MetaTrader 4 (MT4), one of the most popular trading platforms, offers robust backtesting capabilities that can significantly enhance your trading success. In this step-by-step guide, we will walk you through the process of backtesting in MetaTrader 4, helping you unlock valuable insights and optimize your forex trading strategies.

1. Understanding the Importance of Backtesting

Before diving into the practical steps, it’s crucial to grasp the significance of backtesting. Backtesting allows you to simulate trades using historical price data, providing a realistic environment to assess the performance of your trading strategies. It helps you identify strengths and weaknesses, fine-tune your approach, and gain confidence in your trading decisions.

2. Gathering Historical Data

To begin backtesting in MetaTrader 4, you need access to reliable historical data. Fotely, MT4 offers built-in data for various currency pairs and timeframes. Additionally, you can import external data to expand your backtesting possibilities. We’ll guide you on how to obtain and import the necessary data for accurate testing.

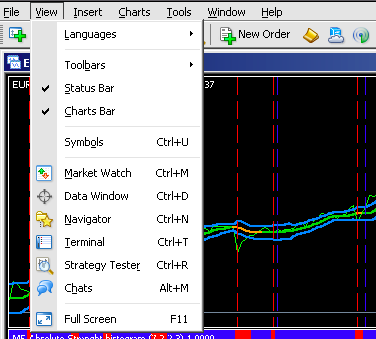

3. Accessing the Strategy Tester

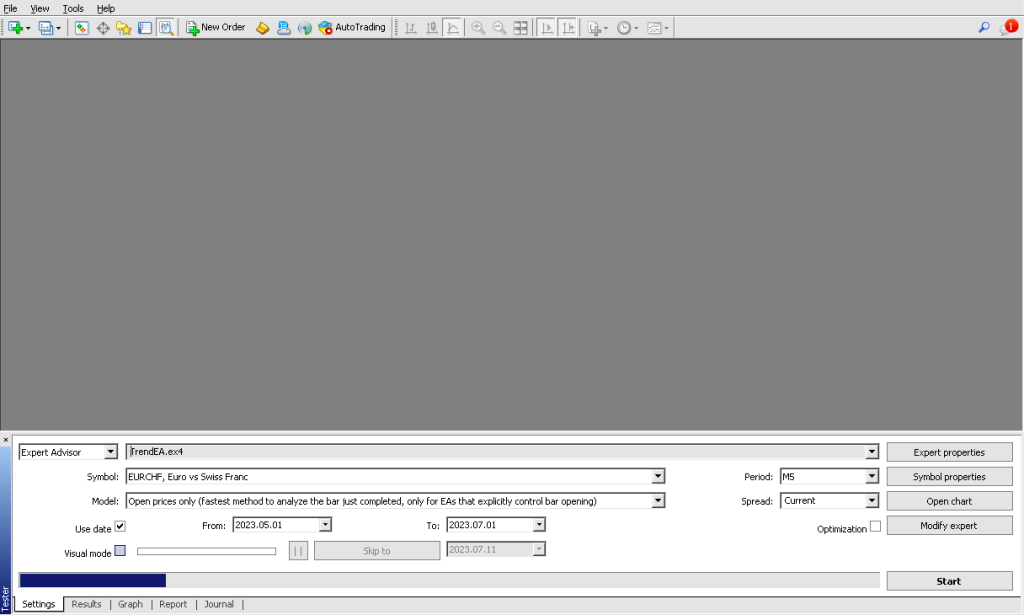

MetaTrader 4’s Strategy Tester is the key tool for backtesting. We’ll show you how to access this feature and familiarize you with its different settings and options. From selecting the currency pair and timeframe to defining parameters and optimization criteria, you’ll gain a comprehensive understanding of the Strategy Tester’s functionality.

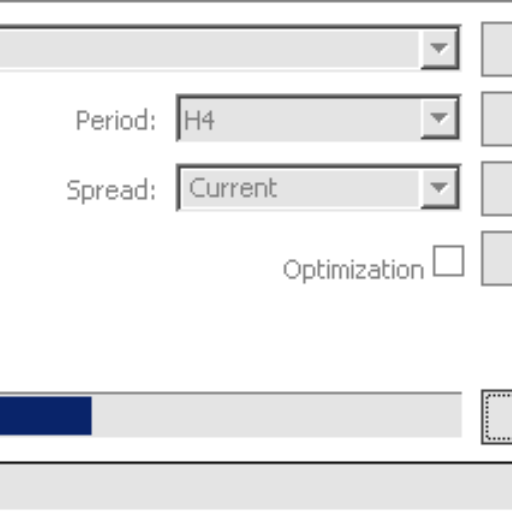

4. Setting Up Testing Parameters:

Before running a backtest, it’s crucial to configure the testing parameters. We’ll guide you through the process of specifying the initial deposit, lot size, and other relevant settings to match your trading preferences. You’ll learn how to define the testing period, select the appropriate model, and set up precise trading conditions.

5. Running a Backtest

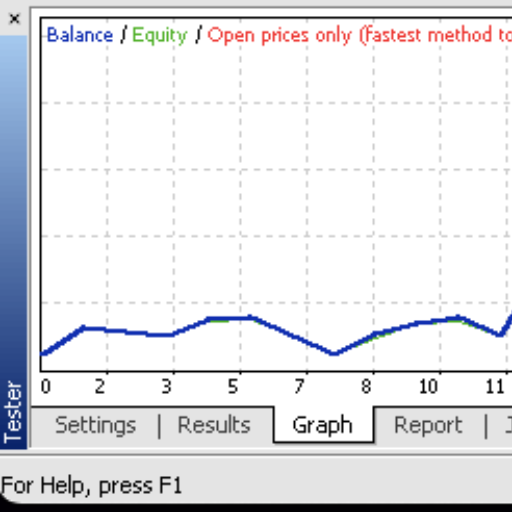

Once the testing parameters are in place, it’s time to run a backtest. We’ll walk you through the process step-by-step, explaining how to initiate the test and interpret the results. You’ll learn how to analyze various performance metrics, including profit and loss, drawdown, and risk-adjusted return, to evaluate the effectiveness of your strategy.

There are 2 types of run in the tester tool of metatrader 4: Optimization and Simulation

A. optimization

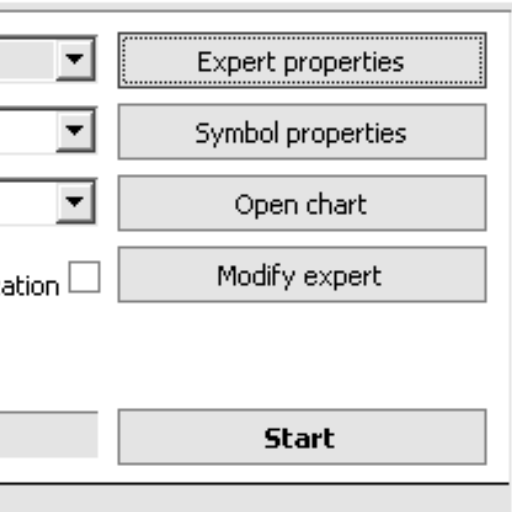

In the image above you’ll see a checkbox that says “Optimization” when this mode is on the run doesn’t simulate the trades through time instead it gives you different combinations of params and creates plot points depicting their profit. In other words, this is your exploration tool. Click each point and it will pre-fill the param box ready for trade test simulation.

B. simulation

This is the normal mode, it is a simple tool that simulates trades and calculates the profit and trade performance. This can be controlled by the params you set or pre-made by the optimizer for you. Make sure that optimization checkbox is unchecked.

6. Refining Your Strategy

Backtesting not only helps you identify profitable strategies but also highlights areas for improvement. We’ll show you how to analyze the backtest results, interpret the data, and refine your trading strategy accordingly. Whether it involves adjusting indicators, optimizing parameters, or incorporating additional rules, we’ll guide you through the iterative process of strategy enhancement.

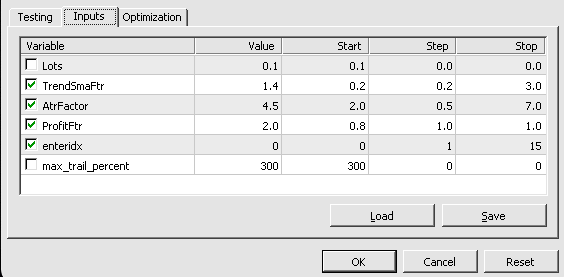

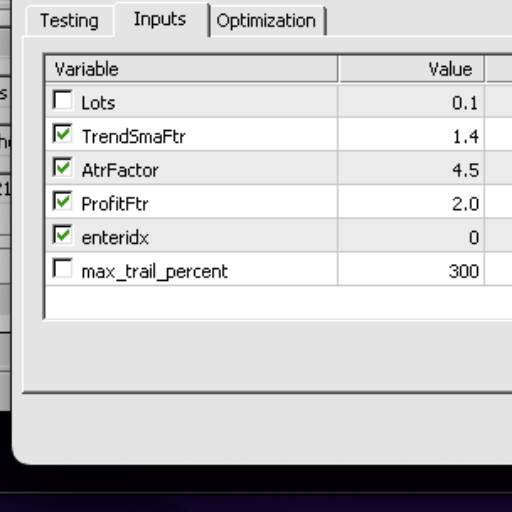

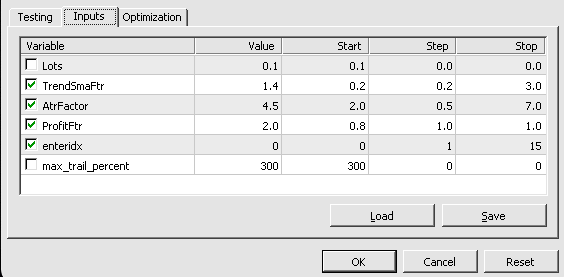

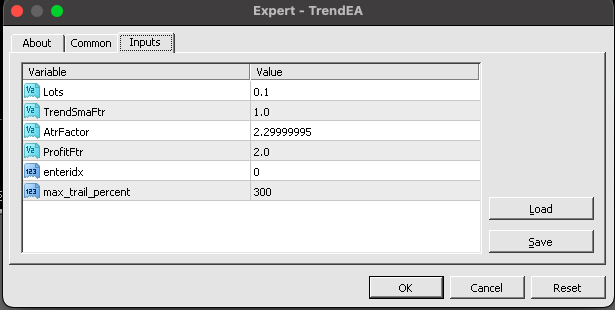

Notice in Expert Properties > Inputs, the column Values are the values that the tester will use. The result of the tester will reflect on the tester’s Results/Graph/Report tabs. Meanwhile Start, Step, Stop column on Inputs are used by the optimizer, the optimizer runs slower than tester as it loops into each variable from Start value and increments on by Step value until it reaches the Stop value. The optimization will give you combinations of values for each variable and plot the equivalent profit it received. Each dot on optimization result is clickable and changes the Tester Inputs Value thereby making it ready for testing. On each change you can run the tester again until you get the result you want. You can save both settings or the optimization result to make it easier to remember. This is how you can properly create a strategy using tester and optimizer.

7. Repeating the Process

Successful traders understand that backtesting is an ongoing process. Markets evolve, and strategies require adaptation. We’ll emphasize the importance of regularly backtesting and reevaluating your strategies to ensure they remain effective in different market conditions. It is important to understand how to load settings and values using the internal of save and load.

When you have perfected your strategy you load the *.set file you create into window of your chosen currency. One last thing to remember, when you are dealing with real money it is important to consider doing a forward test before actual trading. Just use your strategy as you would with real trading and let it run and trigger events that will simulate your trade. If your strategy did well as expected only then can you proceed into using real money.

Conclusion

Backtesting in MetaTrader 4 is a powerful tool that empowers forex traders to refine their strategies, optimize their performance, and make well-informed trading decisions. By following our step-by-step guide, you can harness the potential of MetaTrader 4’s backtesting capabilities and gain a competitive edge in the dynamic world of forex trading. Start your backtesting journey today and unlock the path to trading success.