Are you prepared to improve your proficiency in Forex trading? It’s critical to have a firm command of the indicators that provide insightful data if you want to fully realize the possibilities of the Forex market. We’ll expose you to some of the top indicators successful traders employ in this article. Learn about these effective resources so you can navigate the Forex market with certainty and accuracy.

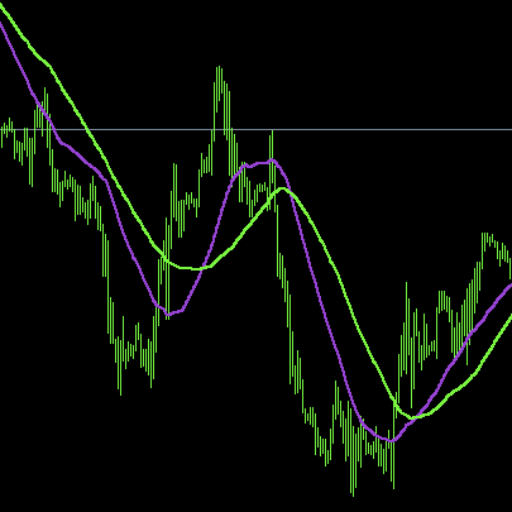

Moveable averages

Technical analysis’s mainstay, moving averages (MA), smooth out price data over a certain period. Simple Moving Averages (SMA) and Exponential Moving Averages (EMA) are frequently used to spot trends and possible market reversals and offer insightful direction.

Remember, Moving Averages are great way to detect changes just by crossing 2 moving average lines with different times, but alone they are not enough. This article only focuses on individual indicators, to create a good trade you have to have at least 3 indicators and confirm the signals.

RSI: Relative Strength Index

A well-liked momentum oscillator for determining the pace and change of market moves is the Relative Strength Index (RSI). The RSI supports traders by determining whether a currency pair is overbought or oversold, which enables them to spot probable trend reversals and take advantage of lucrative trading opportunities.

Using Bollinger Bands

A moving average and two price channels that adjust to market volatility make up Bollinger Bands. Strong price volatility, potential breakouts, and trend reversals are all predicted by these bands. Your capacity to identify important trade signals is improved by incorporating Bollinger Bands into your analysis.

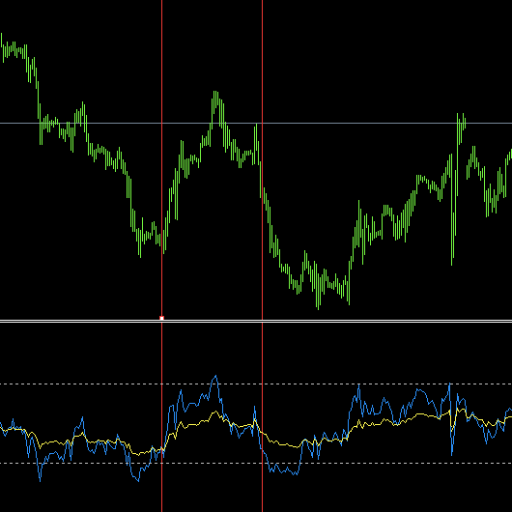

Moveable Average Convergence Divergence, or MACD

A flexible indicator called the Moving Average Convergence Divergence (MACD) combines moving averages to show potential buy or sell signals. The MACD assists in spotting market trends, changes in momentum, and divergence patterns by monitoring the connection between short-term and long-term moving averages.

the Fibonacci retracement

Fibonacci Retracement levels, which are derived from the Fibonacci sequence, offer crucial levels of support and resistance. By identifying potential entry and exit positions with the aid of these levels, traders may ride trends and successfully manage risk. Fibonacci Retracement can help you understand market dynamics better by including it into your study.

Stochastic Oscillator

The Stochastic Oscillator measures momentum by contrasting a security’s closing price over a period of time with its price range. It aids in the identification of overbought and oversold levels, allowing traders to foresee probable reversals and execute trades at the right time.

You may significantly improve your competitive advantage in the fast-paced world of currency trading by utilizing the strength of these best Forex indicators. Understanding and using these indicators will improve your analysis, boost your precision, and reinforce your trading methods whether you’re a beginner or an experienced trader. Don’t forget to put these tools to use and modify them to fit your trading style and objectives.

Armed with these potent indicators, which have consistently demonstrated their efficacy, you may start your Forex trading journey with confidence. Let these indicators serve as your beacon as you traverse the Forex market, making wise choices and taking advantage of profitable opportunities as you go.

Take note that indicators alone are not good on their own it takes skill and analysis to be able to create a profitable portfolio. If you don’t know what this means and come across this article by pure curiosity it is best to checkout this article first.